In our modern, hyper-connected world, the interplay of technology and human interaction has transformed our daily lives. This transformation, while bringing numerous benefits, also opens the door to a darker side – scams and frauds. These deceptive practices are not just a trivial inconvenience; they represent a significant threat to personal security and financial well-being. Understanding the nature of scams and frauds, their evolving forms, and their impact on individuals and society is crucial.

Introduction: Navigating the Digital Maze

The FBI’s Internet Crime Complaint Center’s annual report for 2020 noted over 791,790 complaints of suspected internet crime, a significant increase from the previous year, with reported losses exceeding $4.2 billion. The top crimes reported were phishing scams, non-payment/non-delivery scams, and extortion, with the emergence of COVID-19 related scams as well.

In this comprehensive exploration, we delve into the mechanisms of scams, how they exploit human psychology and technology, and the effective strategies to shield ourselves from these digital predators.

What is a Scam? Unraveling the Deception

Scams are intricately crafted strategies, designed to deceive and manipulate. They are the modern-day equivalent of age-old cons, updated for the digital era. These deceptive schemes cleverly exploit new technologies, societal trends, and even global crises, adapting rapidly to changing environments. Scammers, often perceived as shadowy figures in the digital realm, are not just targeting the gullible or naive; they are sophisticated enough to trap even the most vigilant individuals. Understanding the common tactics used in scams is the first line of defense in this ongoing battle against digital deception.

The Anatomy of Scams

Whether it’s through digital money traps, illusory investments, or manipulative solicitations, these strategies are designed to exploit trust and manipulate emotions. By understanding these key approaches — the art of persuading victims to transfer funds, the allure of non-existent lucrative opportunities, and the exploitation of human emotions — we can better prepare ourselves to identify and avoid these deceptive tactics.

- Digital Money Traps: Scammers artfully persuade victims to transfer funds to fraudulent accounts, often using compelling stories or urgent requests.

- Illusory Investments: They concoct elaborate schemes about non-existent products or services, luring victims with the promise of lucrative returns.

- Manipulative Solicitations: Convincing individuals to part with their money under the guise of various pretenses, these scams often play on emotions like sympathy or fear.

Decoding Fraud: The Hidden Danger

Fraud, the more insidious cousin of scams, involves complex schemes of deception for personal or financial gain. It’s a betrayal of trust, using one’s personal or financial information without consent. The sophistication and variety of frauds make them particularly dangerous, as they can range from unauthorized transactions to complete identity takeovers. Recognizing the signs of fraud is essential in safeguarding personal information and financial assets.

Exploring the Facets of Fraud

- Unauthorized Transactions: These occur when fraudsters gain access to your credit or debit cards, making unauthorized purchases or withdrawals.

- Account Takeovers: A more invasive form of fraud where scammers gain complete control over your bank accounts, often without your knowledge.

- Identity Theft Dangers: Perhaps the most alarming, this involves scammers using your personal details to open accounts, make purchases, or commit crimes in your name.

Strategies for Self-Protection

In this era of digital threats, protecting oneself requires a multifaceted approach. From being cautious about phone calls to securing personal documents, the key lies in proactive and preventive measures.

Fortifying Against Scams and Frauds

- Phone Call Vigilance: In an age where unknown calls could spell danger, it’s wise to exercise caution. Avoid engaging with unrecognized numbers or callers who fail to identify themselves clearly.

- Digital Footprint Control: With social media being a treasure trove of personal information, setting profiles to private is a crucial step in controlling one’s digital footprint.

- Document Safety: Physical statements, often overlooked, can be a source of valuable information for scammers. Proper disposal, such as shredding, is essential.

- Verifying Identities: In any transaction or interaction, knowing who is on the other side is vital. This simple step can prevent many potential scams.

- Financial Prudence: A healthy skepticism towards requests for money or sensitive information can save one from many scams. When in doubt, it’s better to err on the side of caution.

- Business Verification: Before engaging with any company, especially for financial transactions, using resources like the ABN lookup website for verification is a smart move.

- Payment Method Awareness: In transactions, using credit cards can offer an additional layer of security compared to direct bank transfers or debit cards.

Recognizing Common Scams

In an ever-evolving digital landscape, scammers continuously devise new methods to exploit unsuspecting victims. The Consumer Financial Protection Bureau highlights the importance of staying informed about these deceptive tactics, as awareness is a critical defense against financial loss. Scammers are adept at adapting to changing circumstances and technologies, creating a myriad of scams that target individuals in various ways. This section aims to shed light on some of the most common types of scams, providing knowledge that can help you stay one step ahead of these fraudulent schemes.

- Phone Scams: These include a range of deceptive calls, from robocalls that mimic human interaction to impersonators attempting to gain trust or information.

- QR Code Traps: A new digital menace where scammers overlay legitimate QR codes with fraudulent ones, leading to harmful websites or transactions.

- Romance Deceptions: Scammers exploit emotional connections, often in online dating scenarios, leading victims to financial loss and emotional trauma.

- Consumer and Business Targeting: Scams in this category prey on both individual consumers and businesses, offering fake products or services.

- Threats and Extortion: Some scammers resort to intimidation, threatening personal safety or digital security to extort money or information.

- Bank Impersonation Frauds: A dangerous form where fraudsters pose as bank officials to gain access to your banking information. According to Experian, the most common type of fraud is the imposter scam, where someone misrepresents themselves to extract money or personal information from their victim. In 2021, consumers lost a total of $5.8 billion to fraud, with $2.33 billion of that to imposter scams alone.

- Cryptocurrency Scams: With the rise of digital currencies, these scams have become prevalent, often promising high returns in unregulated markets.

- Investment Schemes: Scammers create elaborate, false opportunities for investment, preying on the enthusiasm and trust of unsuspecting individuals.

- Student Loan Scams: Exploiting political and economic situations, these scams target vulnerable individuals struggling with student debt.

- Employment Scams: Offering non-existent high-paying jobs or quick money-making schemes, these scams play on the desire for financial stability. The Federal Trade Commission (FTC) warns about employment scams, such as fake job listings on legitimate platforms like ZipRecruiter and Indeed, where scammers impersonate real employers.

- Identity Theft Scams: These involve stealing personal information for various fraudulent activities, often leaving the victim with financial loss and a tarnished reputation.

- Social Media Product Scams: With the rise of e-commerce on social media, scammers advertise non-existent products at attractive prices, only to abscond with the payment.

- Professional Network Scams: Platforms like LinkedIn are not immune to scams, where fraudsters create fake profiles to exploit professional relationships.

- Delivery Scams: Misleading messages about package deliveries can lead to sharing personal information or receiving unwanted items.

- Check Fraud: A traditional scam where checks are altered to redirect funds, still prevalent in the digital age.

- Pet Purchase Scams: Exploiting animal lovers by advertising pets that don’t exist, these scams play on emotions and the desire for companionship.

Why Do People Commit Fraud? Unpacking the Motives

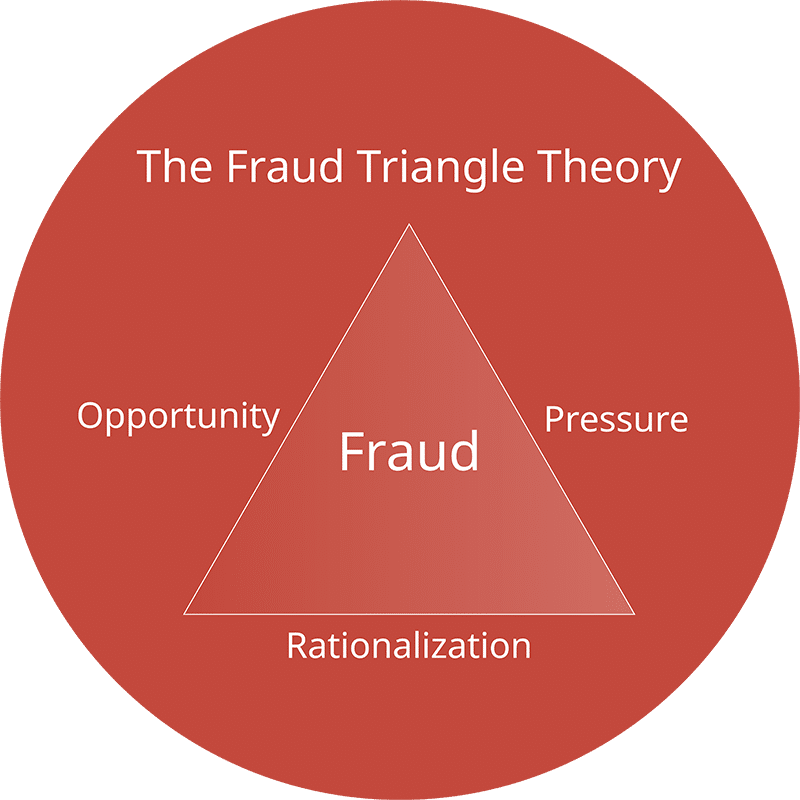

Understanding the root causes of occupational fraud is crucial in its prevention. Criminologist Donald R. Cressey’s Fraud Triangle Theory sheds light on this complex issue. It articulates three pivotal factors — financial pressure, rationalization, and opportunity — that converge to propel individuals toward fraudulent activities. This conceptual framework not only dissects the mechanics of fraud but also delves into the psychological journey, from initial moral reservations to a gradual shift in ethical boundaries, leading to the rationalization of such acts.

The Cressey’s Fraud Triangle

Criminologist Donald R. Cressey’s fraud triangle theory outlines three conditions leading to higher instances of occupational fraud: motivation, opportunity, and rationalization. This model explains that when someone has a reason for committing fraud, the chance to do so without getting caught, and can justify their behavior, they’re more likely to commit an occupational crime.

Criminologist Donald R. Cressey’s fraud triangle theory outlines three conditions leading to higher instances of occupational fraud: motivation, opportunity, and rationalization. This model explains that when someone has a reason for committing fraud, the chance to do so without getting caught, and can justify their behavior, they’re more likely to commit an occupational crime.

- Motivation: Financial pressure is the driving force behind many frauds, where individuals feel compelled by financial needs or desires.

- Opportunity: The final component, where individuals see a chance to commit fraud without the risk of getting caught.

- Rationalization: Fraudsters often justify their actions, convincing themselves that the fraudulent act is necessary or not entirely wrong.

Insights from Inside the Mind of Fraudsters

- Perceived Necessity: Many justify their actions under the guise of a pressing need.

- Initial Moral Hesitation: The transition from the idea of fraud being unthinkable to a viable option.

- Moral Ambiguity: Over time, actions that once seemed dishonest become less so, indicating a shift in moral judgment.

The Psychological Toll of Scams and Frauds

Scams and frauds inflict more than just financial harm; they also have a profound impact on the emotional well-being of their victims. The psychological toll of these experiences is often overlooked. It’s crucial to acknowledge the range of physical and emotional symptoms that can arise from the stress of being scammed, as well as the importance of effective coping mechanisms. Recognizing and addressing these impacts is essential for the holistic recovery and resilience of individuals who have faced such deceptive crimes.

Understanding the Emotional Aftermath

- Physical and Emotional Symptoms: The stress from being a victim can manifest in various physical symptoms, including anxiety and depression.

- Coping Mechanisms: Taking a step back, practicing mindfulness, and seeking support from loved ones or professionals can be immensely helpful in these situations.

Seeking Help and Support

Facing the aftermath of scams and frauds can be daunting, but it’s important to remember that support and resources are available. From specialized support groups to law enforcement agencies, understanding where to turn for help is a critical step towards recovery and safeguarding oneself against future threats. This guidance not only offers practical solutions but also provides a sense of empowerment and reassurance in the wake of such challenging experiences.

WellCome OM Center: Our support group, led by wellness coach Diane Friedberg, offers a safe space for victims of scams and frauds.

Law Enforcement: Local authorities can provide valuable advice on protecting your identity and assets, and assist in case of fraud.

Conclusion: Staying One Step Ahead

In the fight against scams and frauds, knowledge is power. Staying informed, vigilant, and questioning anything that seems suspicious are the best defenses in our increasingly digital world. Remember, if it seems too good to be true, it probably is.

source https://wellcomeomcenter.com/scams-frauds-other-horrors-why-does-this-happen/

No comments:

Post a Comment